|

My corporation's name is Rojo Caliente Corporation and that's Red Hot in Spanish. That is what the Bitterroot Valley real estate market was in this past year. We experienced roughly a 17% in appreciation in residential real estate on properties 40 acres or less. Vacant land also saw a strong uptick. If you have been following me for very long, you know I tell it like it is and I've been lucky and studious for several decades. We rocked the market in 1989 when I predicted we'd have a blow up in the market based on pent up demand for nearly 8 years. And it happened right through 2007.

I think we will continue to have a strong market but let's look at the numbers from 2020 in the Bitterroot Valley.

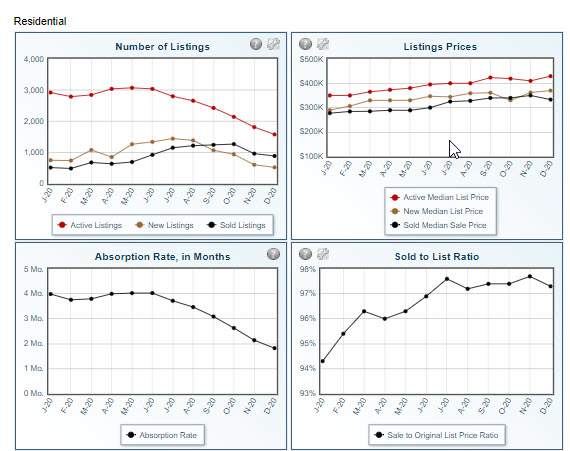

The number of listings has dropped like a rock, listing prices are up steadily, there is roughly 2 months of inventory available and the Sold to List Ratio is nearly 98%. Frankly in this market we are seeing many scenarios where the sales price is many thousands of dollars over "ask". You have to have a team in your corner to navigate a market like this.

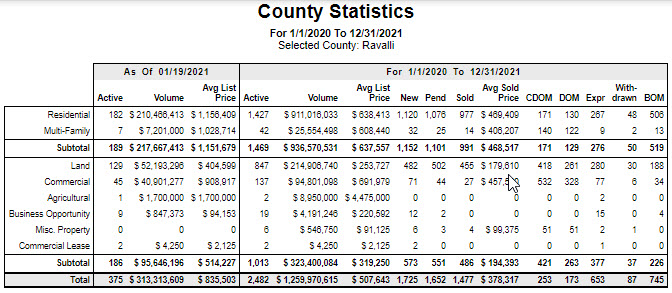

Here are the actual numbers developed from the Montana Regional Multiple Listing System as of 1/19/21:

We have moved from a local board owned MLS system to belonging to a regional MLS system so our method of reporting is a bit different than you've been accustomed to over the past decade. Unfortunately we've lost some of our old market data that we had posted on montanarealestatepro.com. Nonetheless, I think this general data is interesting. It is important to understand that data comes in chunks; we may not have the most up-to-date data and we also round up in our general reporting of numbers for the sake of simplicity. This overview of the 2020 real estate market in the Bitterroot Valley is designed to give you a snap shot of what's happening. So let's dig in.

Townhome and condominiums continue to gain traction. Primarily townhomes because of financing advantages. If you need to get into the weeds on this, we can but not with the group, talk to me after class. Suffice it to say, financing a townhouse is much easier than a condominium and therefore we have seen a surge in townhouse development in the valley, particularly Hamilton.

In 2020 there were 18 condos sold vs. 16 in 2019. The volume was $3.5 million in 2020 vs.$2.8 million in 2019 for roughly a 24% increase. The average condo sold for $174,000 in 2019 but sold for $194,000 in 2020 and the average sold price was 98% of "ask". Contrast that with the townhouse market which saw 6 units sold in 2019 and 26 sold in 2020 for a whopping 337% increase. Volume went from $1.5 million to $6.9 million with average sold prices up 8% overall from $242,000 to $263,000 but selling at 100% of the list price. Our partners are still building condos and competitively and with a financing facility so DO NOT BE AFRAID of condominiums. Just educate yourself on what is the difference; not much.

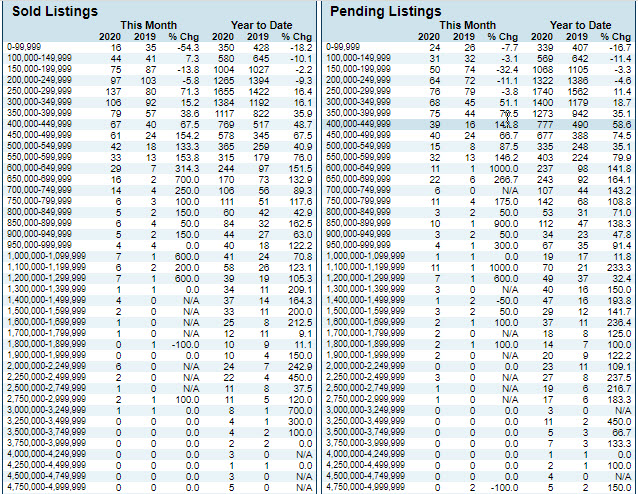

For residential, the Bitterroot had 887 sales vs. 770 in 2019 for a 15% increase. The market has exploded from roughly $300 million in residential sales to over $450 million representing a 45% increase. The average home in Ravalli County went from $389,000 in 2019 to over $490,000 in 2020 and most homes sold for 98% of what they were listed for.

Here is an extensive look at the data. At C&C Real Estate Services Team here at EXIT Realty Bitterroot Valley, we pride ourselves on our research. We give you the hard hitting information you are needing in order to make an intelligent move regarding your real estate transactions whether you are buying or selling.

We can help you make sense of the numbers and the market. We, as a family, have been helping buyers and sellers since 1966. Doesn't it make sense to reach out to trusted experience when the market is this hot?

|

Home Improvement Decisions You'll Never Regret

|

|

|

|

When it comes to home remodeling, there are very few design decisions you can make that are sure to stand the test of time. While it can be tempting to opt for trendy renovations (open shelving anyone?), there's no guarantee that the next buyer - or your future self - will share the same preference. We're all painfully aware that the future is tough to predict, but there are a handful of decisions you can make on home improvements that won't keep you up at night, regardless of market forces.

Infrastructure

When it comes to remodeling, there are fewer sure-fire bets than investing in a home's infrastructure. Investing in updated electrical and HVAC systems, siding, plumbing, insulation, and windows can yield tremendous ROI for homeowners whether they're dwelling or selling. These systems are often hidden behind walls and under floors, so they're easy to ignore. However, neglecting your home's infrastructure can lead to inconvenient and costly repairs and can be hazardous to your family's health and safety. There's a reason home inspectors spend most of their time in attics and crawlspaces – the overall health of your home has less to do with aesthetics and more to do with what's behind the scenes.

Storage

Storage is a consideration that can be easily overlooked when you're imagining your dream living space, which is almost by design - practical and efficient storage is meant to be out of sight, out of mind. Whether you plan to stay in your home or sell in the near future, sacrificing storage space is a decision you'll likely regret. If your remodel demands eliminating a hall closet, make sure you have a plan to reorganize and add that storage back elsewhere. It's impossible to predict what life changes your home might need to accommodate in the future, and if you plan to sell, ample storage will be a plus for practically any prospective buyer.

Lighting

It can be tempting to see lighting as an afterthought, but in actuality lighting should be a starting point, as it impacts every detail in a room. Take time to research and create a lighting plan that best accentuates the features of your home, taking into account natural light and ways to implement accent lighting. When the time comes to implement your plan, you can't go wrong with a licensed electrician who can ensure all changes are up to code.

|

|

|

|

Running the Numbers on Refinancing

|

|

|

|

Deciding whether or not to refinance an existing mortgage typically means running some numbers. You can do this on your own, but it’s helpful to get the professional assistance of a loan officer. It mostly boils down to how much you’ll save each month, but there are other considerations.

First, the change in rate isn’t everything. Old school rules say that it’s a good idea to refinance if current market rates are 1% or 2% lower than what you currently have, but the rate is only a part of it. The other component is the amount being financed. For larger loan amounts, a reduction of only 0.5% might make sense. For smaller loan amounts, 2% may not be enough.

Instead, calculate the monthly savings and then divide that amount into the closing costs associated with the mortgage. The result is how many months it will take to ‘recover’ the closing costs in the form of monthly savings. Pay less attention to the actual rate but instead how long it will take to get your closing costs back.

Take a loan amount of $300,000 over 30 years with a rate of 4.50%. The principal and interest payment works out to $1,520 per month. If current market rates are at 3.5%, the new payment would be $1,347 for a savings of $173 per month. If closing costs were $3,000, then it would take just over 17 months to recover the associated fees. Not bad. If the loan amount were $100,000 under the same scenario, the monthly savings would be $57 and recovered in 52 months, or more than four years. Probably not a good idea in that situation.

There are other considerations outside of month-to-month savings. Let’s say you’re less concerned about lowering your monthly payments, and you’re more interested in paying off your house faster. In this scenario, it may make sense to refinance at an even lower interest rate on a 15-year mortgage. You’ll pay more per month, but you can potentially save tens of thousands of dollars over the life of your loan.

If you’re wondering whether a refi makes sense for you, reach out! I’ll be happy to answer any questions and can refer you to a mortgage professional when you’re ready to crunch some numbers.

|

|

|