2022 Year End Market Report

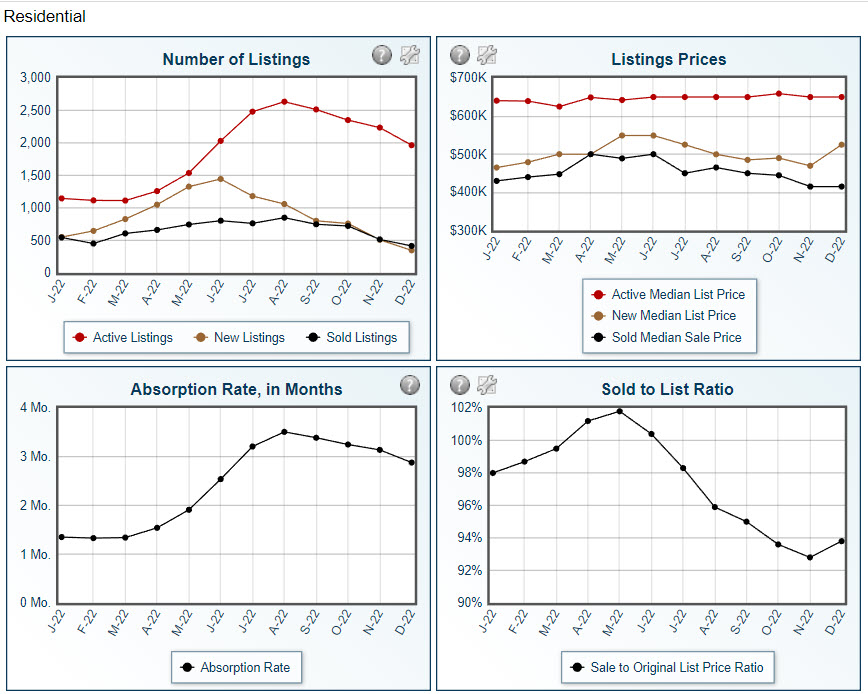

Here is our year over year market report for 2022. There was a major shift in the market in this mid term election year and a major factor was due to Federal Reserve action to stem the inflationary trend in the economy. Every mid term year I have observed the market slowing down in about August. This year was no exception and it seemed things cooled off in about July of 2022. Additionally, mortgage interest rates are currently about twice as much as they were at the start of 2022. This movement in increased interest rates took millions of buyers out of the market which in turn had the effect of increasing inventory. Naturally since demand was down a bit, we saw more price adjustments moving pricing down. In June of 2021 the over all regional market experienced a sale to list ratio of 102%. That really was the top of the market. Currently we are seeing approximately 97% of ask being the sale price of most properties.

We always caution our clients that these reports are statistics and, as Dad would tell us, there are three kinds of lies; lies, damned lies and statistics. I always thought that was Dad's original but it is attributed to Benjamin Disraeli, prime minister of the UK from 1874 to 1880 and made popular by Mark Twain. The point being that we give you rounded numbers and a general idea of what is happening in the market place vs. what happened in the past so we might be able to determine trends.

Condo sales bucked the trend a bit in 2022 with 13 sold in 2021 vs. 28 sold in 2022 for an increase in units of 115%. The overall volume of sales went from $3.5 million to $10.2 million for a whopping 194% increase and the average sale went from $267,000 to roughly $365,600, up 36% and the average property sold at 100% in 2022 against 101% in 2021.

Townhouse sales went from 33 in 2021 to 26 in 2022. In part due to availability of product. Total volume in 2021 was $10.1 million and $10.6 million in 2022 for an increase of 4%. The average price was up from $307,000 to $408,000, an increase of 33% and the ratio of sale to list price was 100% in 2021 to 99% in 2022.

Residential slowed in terms of the number of units and volume of sales. There were 801 residential properties sold in 2021 vs. 625 in 2022, down 21% and volume went from $525,800,000 to $443,300,000 for a 15% decrease. The average residential property sold for $656,426 in 2021 and $709,262 in 2022 for an 8% increase. This general appreciation was significantly less than the increase we saw in 2021 over 2020. The list to sale price for residential for 2022 was 98% of ask and it was 100% sale to list in 2021.

Land sales also showed a marked decrease in activity with 317 units selling in 2021 vs. 166 parcels in 2022, down some 47%. The overall volume of land sales went from $75.2 million to approximately $48 million for a 36% decrease. The average land sale went from $237,000 to $289,000 which represent a 21% increase and the sale prices in 2022 were at 96% of list price vs. 98% in 2021.

The market continues to adjust. Clearly demand is down which will impact pricing. Additionally, from 2013 to 2019 the market increased very steadily at approximately 7.5% per year. In 2022 it was roughly 8% which gets us to a more stable market. However, with such a huge up tick in pricing in 2020 and 2021, there is very likely going to be movement in 2023 in the other direction leaving room for buyers to be selective about properties with growing inventory and the ability to negotiate price. Sellers are still getting good pricing so there should be no worry about extracting equity and buyers are getting a bit of a reprieve in price escalation. Look for continued price adjustments on most properties in 2023 but good agents are reacting to the market with pricing models which reflect the current market trends.

Remember that C&C Real Estate Team here at EXIT Realty Bitterroot Valley can do extensive property and market research for you. Char is in the Polson office and we are handling real estate from Flathead County, Sanders, Lincoln, Mineral, Granite, Missoula and Ravalli Counties as well. We have offices in Darby, Hamilton, Stevensville, Missoula, Polson, Helena, Great Falls and Laurel for those looking in the mid state area around Billings. The Siphers family has been serving buyers and sellers since 1966, trust the experience.

Pod Cast Coming

Craig will be doing a pod cast starting sometime in February. Look for details in the February news letter. The pod cast will feature local personalities, businesses and great things to experience in the Bitterroot Valley. We also have a new Youtube account that will provide excellent real estate content. You can find it at Siphers Family Real Estate Since 1966.

Check it out and Subscribe for western Montana Real Estate and general real estate insights.

Bitterroot Valley Real Estate- Craig Siphers, Senior Broker

Providing trusted consultation on buying and selling Montana

real estate for over 30 years in Lolo, Florence, Stevensville,

Victor, Corvallis, Hamilton, and Darby. Call or text Craig Siphers

at 406-360-9108 to make a legendary deal!